income plus

| Asset Class/Style | Canadian Income / Value |

Overview

A combination of primarily our focused Canadian dividend (income) equity strategy and our short mid fixed income strategy to provide consistent income and moderate long-term capital appreciation.

Investment Process

Lincluden has consistently applied a value-based investment philosophy since its inception. Portfolio managers operate under the belief that financial markets are efficient in the long run but can be inefficient in the short and medium term providing an opportunity to identify mispriced securities. Equity portfolio managers are assigned sector responsibilities on a global basis. Each portfolio manager is charged with identifying investment opportunities within their area of responsibility. Portfolio construction is implemented with an objective of producing a portfolio with superior risk/reward characteristics, ensuring prudent diversification. The combination of thorough quantitative and qualitative analyses allows the team to identify companies trading at a substantial discount of fair value. A focus on cash flow in determining a company’s valuation reflects the fact that free cash flow is the best currency to enable a company to grow. By relying on their own original, in-depth research – portfolio managers are able to act with confidence and conviction when investing in securities which may be overlooked by others. The approach culminates in portfolios of high-quality dividend paying companies with excellent prospects for long-term appreciation.

Our fixed income portfolios are structured to achieve the most efficient combination of duration, credit, yield curve and foreign exposure from a long-term risk-reward perspective. Our fixed income team members collaborate on the primary portfolio strategies, while execution responsibilities are allocated between the Portfolio Managers.

Our investment process begins with an economic overview, which allows us to develop a view on inflation – the key determinant of interest rates. Based on our view of value and risk, we then determine the appropriate portfolio duration which reflects our long-term view of inflationary trends relative to the current level of interest rates and shape of the yield curve. We believe that real interest rates should be considered using long-term inflationary expectations instead of the current rate of inflation.

Our exposure to credit risk through corporate, provincial and municipal government issues is a reflection of our detailed credit analysis and evaluation of risk-reward valuation characteristics. We do not rely on rating agency reports for our evaluation of risk; instead we emphasize internal research by the fixed-income team, with support from the equity team.

Strategy Description

Investment Objective

The investment objective of the Income Plus strategy is to generate consistent income and moderate long-term capital appreciation by investing in a portfolio of fixed income and equity securities.

|

Investment Strategies

The investment objective of the Income Plus strategy will be achieved by investing primarily in Canadian income producing securities across a range of asset classes including, but not limited to, government and corporate bonds, preferred shares, income trusts, and dividend paying stocks.

Securities will be selected using a value based, bottom-up process, in order to identify attractive investment opportunities. The portfolio of securities will be diversified to reflect a variety of companies and sectors. Securities will also be selected to provide a combination of income and moderate growth potential.

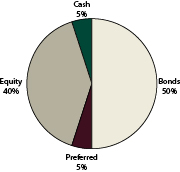

The asset mix for the Income Plus strategy will include the following guidelines:

| Asset Mix | Minimum | Maximum |

|---|---|---|

| Cash | 0% | 25% |

| Bonds | 25% | 100% |

| Preferred Shares | 0% | 20% |

| Common Equity (including Income Trusts) | 0% | 70% |

| Other | 0% | 20% |

| Foreign Pay Securities

(within the context of the above ranges) |

0% | 25% |

No single corporate issuer may exceed 10% of the Income Plus Fund’s portfolio at any time. An individual preferred or common share will generally not exceed five percent (5%) of the total portfolio of the Income Plus Fund at time of purchase.

The Income Plus strategy may hold significant cash or cash equivalents pending investment or if such cash holdings are desirable as a result of market conditions. Derivatives, such as options and forward contracts, may also be used to hedge against currency exposure or to generate additional income.