private clients

At Lincluden, we believe that a balanced portfolio approach to investing using a value-based philosophy is best-suited to the stability and growth of personal wealth. The appropriate asset mix for an individual or family will be determined following a review of the client’s investment objectives, tolerance for risk and capital market conditions. We will work with clients to create portfolios that meet their long-term investment objectives. In each client’s case our investment decisions will be guided by our own independent, fundamental research in order to maximize long-term returns at a controlled level of risk. Lincluden is committed to providing a high quality level of client service and communication.

Investment Philosophy

Lincluden has adhered to a value-based philosophy since the firm’s inception in 1982. We believe that a balanced portfolio approach to investing using a value investment style is best-suited to individuals and families focused on capital preservation, moderate income and long-term growth with an acceptable level of risk.

Building Client Portfolios

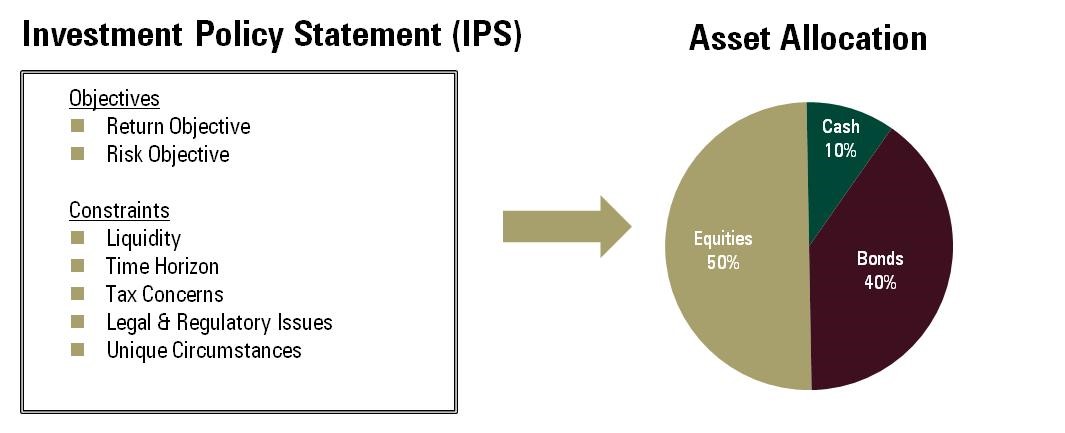

Each client relationship begins with a thorough discussion and examination of their personal circumstances as they relate to their financial goals. We work with the client to establish their return and risk objectives. These objectives, along with an outline of any liquidity constraints, time horizon, tax concerns, legal and regulatory issues, and other unique circumstances that may apply, help form an Investment Policy Statement (IPS) which will govern the relationship. The IPS will outline the appropriate asset allocation for the client in terms of how much should be invested in cash, bonds, and stocks. We review our client’s profiles on a regular basis and will update their policy as required.

|

Segregated and Pooled Investment Management Services

We offer our private clients the option of either segregated account management (i.e. holding individual securities such as stocks and bonds) or investment through our pooled funds. For a list of our investment products and strategies please refer to our pooled fund fact sheets.

Client Service

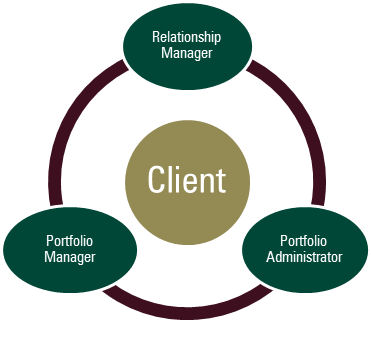

Lincluden is committed to providing a high quality level of client service and communication to ensure that a client's investment objectives are being met. All clients are assigned an experienced 3 person team; a relationship manager as your key point of contact, a portfolio manager to oversee your account, and a portfolio administrator to ensure ease of back office functionality and full compliance with your Investment Policy Statement (IPS) and applicable securities regulations.

|

Reporting

The flexibility built into our portfolio accounting system allows us to generate customized reports for clients who have specific requirements. The frequency of reporting is generally done on a quarterly basis. We provide clients with a Quarterly Investment Review which includes an economic commentary, discussions on portfolio strategy, a portfolio valuation report, and performance and compliance summaries. In addition Ad hoc reports can be produced based on the client’s needs such as specific tax reporting.

Custody and Safekeeping

Lincluden does not act as the custodian for our client’s assets. We have established a working relationship with several global custodians who are responsible for the safekeeping of the assets. Please note that we have a preferred pricing arrangement in place with RBC Investor Services which may be of interest to clients who do not already have a custodian relationship in place.

Fee Schedule

Our fee schedule is available upon request.

Contact

Wayne Wilson

Vice President, Marketing & Client Service

(905)-273-3018

Wayne.Wilson@Lincluden.net