balanced

| Asset Class/Style | Canadian Balanced / Value |

Overview

Balanced funds managed on a discretionary basis will have an equity bias over the long run with a neutral target mix of 60% stocks and 40% bonds. Equities can have a maximum weighting of 70% and a minimum weighting of 45%. Balanced portfolios benefit from the insights of Lincludens entire team of investment professionals.

Investment Process

Lincluden has consistently applied a value-based investment philosophy since its inception. Portfolio managers operate under the belief that financial markets are efficient in the long run but can be inefficient in the short and medium term providing an opportunity to identify mispriced securities. Equity portfolio managers are assigned sector responsibilities on a global basis. Each portfolio manager is charged with identifying investment opportunities within their area of responsibility. Portfolio construction is implemented with an objective of producing a portfolio with superior risk/reward characteristics, ensuring prudent diversification. The combination of thorough quantitative and qualitative analyses allows the team to identify companies trading at a substantial discount of fair value. A focus on cash flow in determining a company’s valuation reflects the fact that free cash flow is the best currency to enable a company to grow. By relying on their own original, in-depth research – portfolio managers are able to act with confidence and conviction when investing in securities which may be overlooked by others. The approach culminates in portfolios of high-quality dividend paying companies with excellent prospects for long-term appreciation.

Our fixed income portfolios are structured to achieve the most efficient combination of duration, credit, yield curve and foreign exposure from a long-term risk-reward perspective. Our fixed income team members collaborate on the primary portfolio strategies, while execution responsibilities are allocated between the Portfolio Managers.

Our investment process begins with an economic overview, which allows us to develop a view on inflation – the key determinant of interest rates. Based on our view of value and risk, we then determine the appropriate portfolio duration which reflects our long-term view of inflationary trends relative to the current level of interest rates and shape of the yield curve. We believe that real interest rates should be considered using long-term inflationary expectations instead of the current rate of inflation.

Our exposure to credit risk through corporate, provincial and municipal government issues is a reflection of our detailed credit analysis and evaluation of risk-reward valuation characteristics. We do not rely on rating agency reports for our evaluation of risk; instead we emphasize internal research by the fixed-income team, with support from the equity team.

Strategy Description

Investment Objective

The investment objective of the strategy is to generate both capital appreciation (growth) and income, while maintaining a relatively low level of risk. To achieve its objective, the strategy invests in a diverse portfolio of stocks, government and corporate bonds, and short term instruments such as Government of Canada treasury bills.

|

Investment Strategies

Our investment philosophy is broadly defined as value oriented. The philosophy is consistently applied at the asset mix level and within each asset class.

Equity management is fundamentally driven in order to identify securities that are trading at a substantial discount to our appraisal of their fair value. We screen a broad universe of Canadian, U.S. and international stocks across the capitalization spectrum in its search for securities which are undervalued. The broader economic, capital market, and sector factors at work receive less weight our analysis than company specific information. The Fund invests in a wide variety of industries and companies in order to reduce risk through diversification.

The fixed income management approach is based on the view that the economy and financial markets behave in a cyclical fashion and that markets are not always efficient in recognizing relative value and risk. We are committed to structuring a portfolio that achieves the most efficient combination of the duration, credit, yield curve and foreign-pay exposure variables from a long term, risk reward perspective. The term to maturity decision reflects an analysis of current interest rates relative to anticipated inflation. Security selection decisions reflect a thorough assessment of a detailed credit analysis of the issuer. Corporate bonds generally represent a significant part of the Fund’s portfolio.

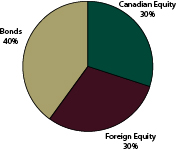

The balance between fixed income and equity investments will depend on relative valuations in the financial markets. The Fund will normally invest between 40% and 70% of its assets in stocks and between 30% and 60% in fixed income securities. We anticipate that over the long term equity exposure will average 60% and fixed income exposure 40% in order to achieve a balance of growth and income, though these percentages will vary from time to time. It is expected that foreign exposure will not exceed 45% of the assets. The Fund anticipates that its exposure to cash and cash equivalents will not exceed 15% of its assets. However, that range may be exceeded for short periods of time if the Fund experiences significant increases in net contributions over a short period of time, for defensive purposes, for rebalancing purposes or for purposes of a merger or other restructuring transactions.